|

| "I have come down" repeats Grandfather Smallweed , hooking the air towards him with all his ten fingers at once to once, "to look after the property".(*) |

Scan credit: George P. Landow at Victorian Web

Stephen Hester will step down from the leadership of RBS this month with a payoff thought to be in the region of £1.6m, according to Wiki, nearer to £6m if you include share options (according the The Mirror). He earned around £1.2m a year, making £6m over his term in the seat, and took an additional £6.5m in bonuses and pension payments in 2010, after which people started to put pressure on the new government to DO something.

Only, since Stephen Hester was a Conservative donor, they didn't try very hard and as for the Lib Dems, Vince Cable decided to ignore the occasional story he heard, adopting his standard position of hazy old duffer who cannot be expected to remember anything or grasp the significance of it if he does.

At the time of the previous story which featured Hester, it was felt that I had been rather hard on a man who was not in direct control of the insurance group and anyway, was turning round a failed bank. Furthermore a man who knew the difference between right and wrong and had said so in a video interview to the Telegraph. (May be behind a paywall, depending on your usage)

"It is an extreme example of a selfish and self-serving culture which the whole banking industry is tagged with," he said, adding that it was the board's job to ensure that sort to behaviour has no "validity in the future".It recently emerged that RBS used another special group of which Hester will no doubt claim to have come over all Vince Cable about, the Global Restructuring Group, GRG, with thanks to Felix Salmon at Reuters who has presented the story clearly. RBS foreclosed loans because it could get more immediate value out of stripping the assets the debtors had put their lives in to. Using the GRG group, it engineered defaults to give itself permission to help itself to the fruits of other people's labour, selling them a knock-down prices to its own subsidiary, West Register.

Perhaps unusually in this day and age, the story seems to have bubbled under with the debtors being unable to form a coherent pressure group. Possibly that is because it is very difficult to distinguish, from the outside, a good business being pushed under by the bank and a bad business which should be stopped before it gets any worse. When stories started emerging in July 2013, RBS and Hester coolly said they could not comment on individual cases, implying that debtors must all be unreliable complainants - and no doubt some of them are. The Tomlinson Report draws together the method the bank used. Lawrence Tomlinson also credits an investigation by the Sunday Times and the work of Sir Andrew Large.

Many in the banking trade have counted on this story being too convoluted to grasp . They have forgotten that Mr Dickens already explained it in 1853. This year was the 160th anniversary of the conclusion of Bleak House.

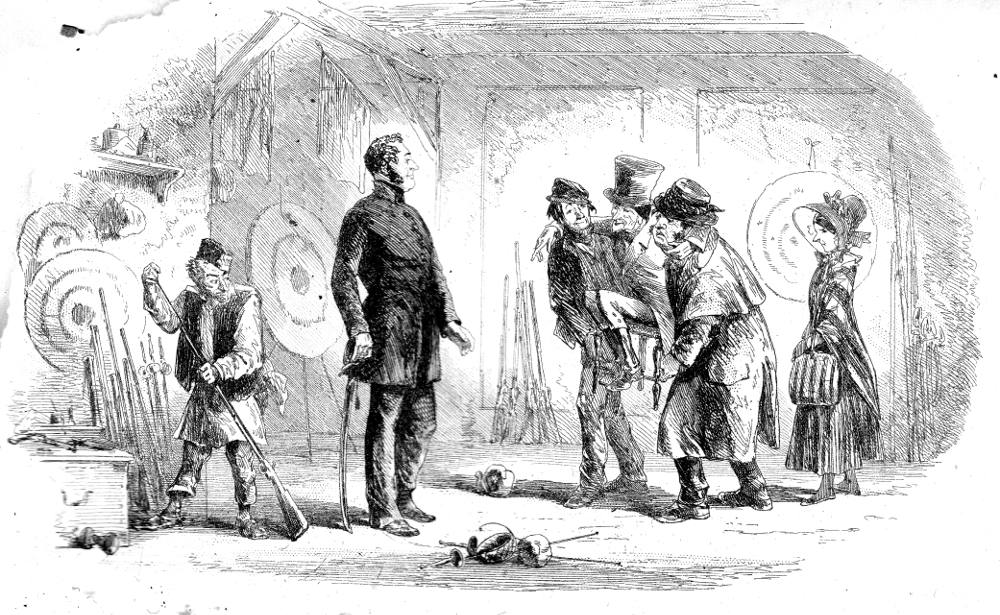

In the illustration above, the old payday lender Smallweed has extended rolling credit to Captain George who has used it to buy a shooting gallery. This barely makes enough to keep him and an assistant in tea and bread but earns just enough to keep paying Smallweed his interest. Probably it is a bad business but George is making his payments and trade might improve.

It then transpires George has an asset he was not aware of; he holds a letter from a late friend which can be used as a sample of handwriting to positively identify the writer of other documents and letters. Smallweed knows to whom that sample has value and he wants to be rewarded for brokering the deal. The only trouble is, George takes advice and is certain that he does not want to be involved.

Smallweed then brings pressure on him because the loan is not secured just against George's own person but the property of his friend Mr Bagnet. Smallweed demands full repayment, knowing full well that George has no way to do it and must therefore surrender the letter for inspection. Which he does.

If people are capable of following the plot of Bleak House and how Smallweed manipulates George to get what he wants, they are capable of understanding what RBS was doing. Shake me up, Judy.

........................

(*) Yes, I know Smallweed says this when he goes to Krook's house rather than George's shooting gallery, but the sentiment fits best.

4 comments:

If after a number of instances of this being uncovered, and all this value going not even astray but into the left-hand pocket while the right hand was still trembling on the lever that sets the carousel in motion, can we not call this stealing and summon a constable or two?

Heaven preserve your sweet trusting soul, Sir. For a solution we must look to another novel by Mr Dickens - A Tale of Two Cities.

Since 2000, the gathering of power has been along both financial and information lines:

But one day, this won't work (or this leverage will be withdrawn on purpose) and the next great depression will hit. The government will call in its bonds and loans, and credit card debts will be called in. There will be massive bankruptcies nationwide. Europe will stabilize first ...

And:

Google have apparently been buying up lots of robotics firms lately – eight in the last six months – with a view to some unspecified future robotics projects.....Boston Dynamics has multi-million-dollar contracts with the US military's advanced research division, Darpa

It does not seem for the good of our health. Calling in debts and knowing where you are and where you'll be are pretty powerful things.

Agree, James.

Did you notice today's story that the sensible firm Birds Eye is in trouble? It was bought by private equity which then used it to raise loans, paid themselves the money and left the firm with massive, possibly unserviceable, debts.

What I want to know is who extended the loans to Birds Eye and on what basis? There is a point at which cynical lenders deserve to be burned for their collusion.

This is not capitalism; it is gangsterism, akin to mortgage fraud.

Post a Comment